Around 19 million people aged 50+ in the UK are not considering annuities, which provide a guaranteed regular retirement income

- While most UK adults aged 50+ are unwilling to take risks with their money, the majority will not consider annuities which can guarantee a regular retirement income [1].

- Despite annuity rates increasing significantly since the start of 2022, when the survey was conducted in March 2023, only two in 10 said improved rates make them more likely to buy one.

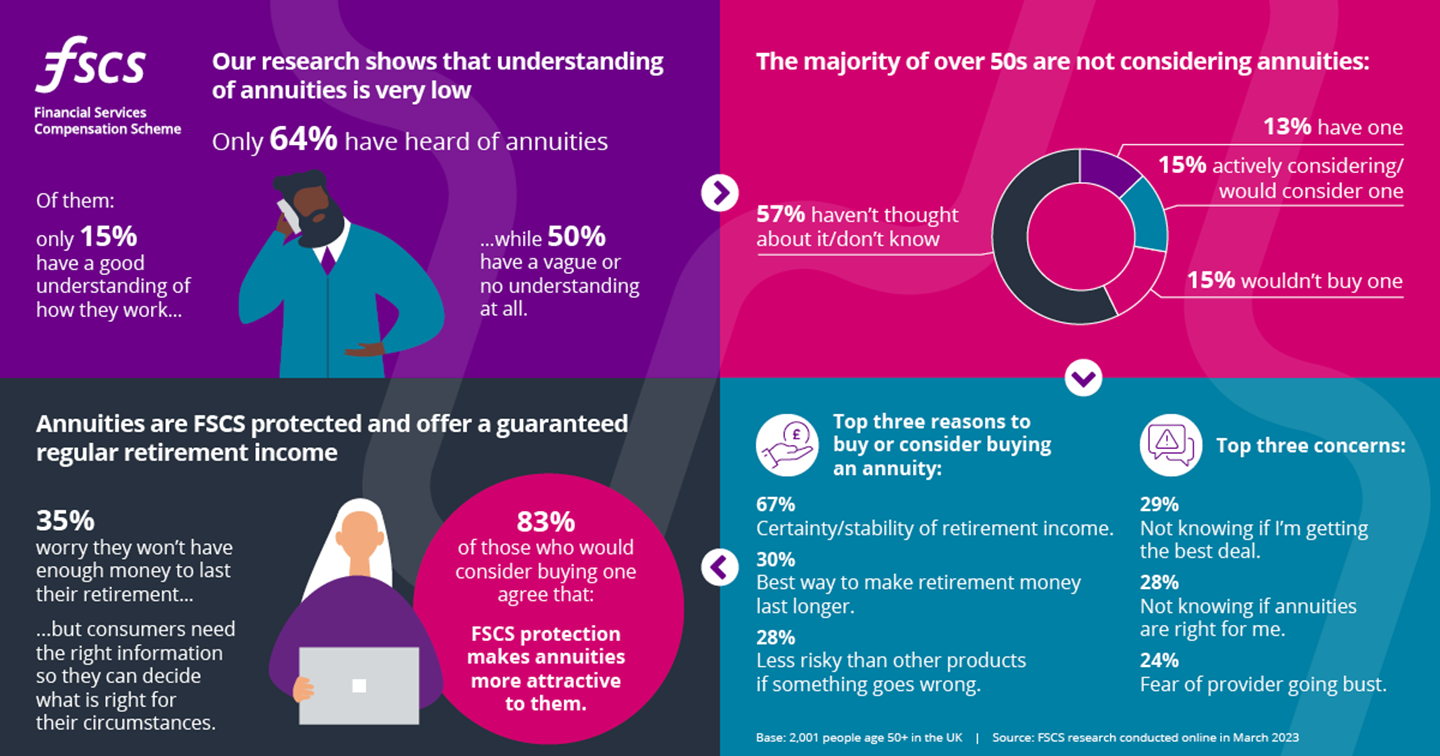

- New research from FSCS shows that there is a significant mismatch between UK adults aged 50+ who are unwilling to take risks when it comes to their retirement savings and their knowledge about annuities as a retirement product.

- The findings point to a greater need for better education amongst this group of people, and the importance of getting regulated advice about the details of specific products and the pros and cons to all options available for their pension pots, so they can choose the right products that align with their personal risk appetite and retirement choices.

London – New research released today by the Financial Services Compensation Scheme (FSCS) reveals that risk appetite amongst UK adults aged 50+ is low when it comes to money, with only one in 10 (10%) of UK adults aged 50+ saying they are willing to take risks with their money. Yet, when it comes to annuities less than one-third (28%) of UK adults aged 50+ either have an annuity or would consider buying one.

With 26.5 million people aged 50+ across the UK, this means an estimated 19 million people may be overlooking a pension option that could guarantee regular retirement income. The research points to a mismatch amongst the over 50s regarding their wants and how they behave. While most of this group consider themselves to be risk averse, the majority will not consider a pension option that could offer the security of a regular income over a set period of time.

Despite more than one-third (37%) of respondents who are unwilling to take risks saying they are worried about not having enough money to last the duration of their retirement, more than half (58%) of this same group of people admit they have a vague or no understanding of annuities. Even when asked whether improved annuities rates would make the product more attractive for them, fewer than three in 10 (29%) agreed with this statement.

Those UK adults aged 50+ that are risk-averse list the following as some of their top concerns about annuities: not knowing if annuities are right for them (29%), fear of provider going bust (26%), not understanding how annuities work (25%) and a lack of protection if something goes wrong (25%).

Annuities that are provided by UK-regulated insurers are fully protected by FSCS, so the Scheme can pay compensation to eligible customers with no upper limit if the annuity provider goes bust.

Of those respondents that would consider buying an annuity, the majority (83%) agree that the fact that the product is FSCS protected to eligible customers makes it more attractive to them. They also list certainty of income (73%) and the fact that it is less risky than other products (36%) as one of the reasons for their interest in an annuity.

Lila Pleban, Chief Communications Officer at FSCS, said: “It is not surprising that most UK adults aged 50+ are risk averse when it comes to their money. At this stage of people’s lives, they are likely to choose safety and stability over volatility and uncertainty. However, what is surprising is that many people are not willing to even consider an annuity because they don’t fully understand what it is.

“There are pros and cons to every option out there for your pension pot, whether you choose a guaranteed income or a more flexible drawdown approach, and retirement choices are very personal. Accessing regulated financial advice or free and impartial guidance from services such as MoneyHelper may help people to better understand the money and pension choices available to them.

“It is clear from our latest research that those aged 50 and over must have access to the knowledge and tools they need so they can choose the right retirement product for them. That’s why at FSCS we are committed to empowering and educating consumers, so they feel confident about the decisions they make when it comes to their money.”

[1] According to NOMIS Official Census and Labour Market Statistics the total number of adults aged 50+ is 26.5 million. Of those respondents who completed FSCS’s survey, 72% said they don’t have or wouldn’t consider buying an annuity. 72% of the estimated 26.5 m people equates to 19 million people.

Media enquiries

Email publicrelations@fscs.org.uk or fscspressoffice@hanovercomms.com